The Effects of RIA Stack Fragmentation

Plus: Fintech in Q3

Welcome back to Fintech Prime Time, our monthly delivery of fintech industry data and analysis based on the F-Prime Fintech Index. This month we’ve got a small preview of our next subsector deep dive, plus a look at how falling interest rates have affected publicly traded fintech companies.

Sneak Preview: A Wealth Tech Deep Dive

By Sarah Lamont

The last decade of wealthtech investment has been marked by the success of high-profile names like Robinhood and Coinbase (two companies we track in the F-Prime Fintech Index), but despite the success of many direct-to-consumer businesses, there are equally exciting opportunities emerging in the world of traditional advisor technology. Several market shifts — an expected $84T wealth transfer, the rise of alternative assets, breakaway RIAs, and advances in AI — all represent an opportunity to rebuild the industry’s technology infrastructure.

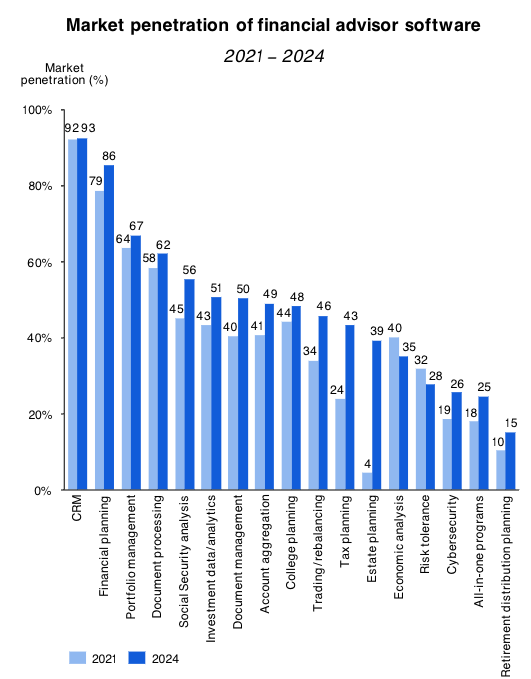

Startups are already wise to this opportunity. Witness below the jump in market penetration for estate planning software — from four percent to 39 percent between 2021 and 2024. High-profile funding rounds from players like Vanilla and Wealth.com this year also help demonstrate how hot this sector is as of late.

In the above chart — which comes from our upcoming State of Wealth deep dive, due out next month — you can also see the growing sprawl of the advisor’s tech stack. RIAs must now contend with a wide array of tools with little-to-no integration across platforms, and startups have emerged to create tighter integrations.

There are three main approaches to this problem:

Some players are creating pre-integrated tech stacks via acquisition. For example, Orion Advisor Solutions started life as a portfolio management tool that acquired financial advisor CRM Redtail and investment and trading platform TownSquare Capital in 2022. The goal here is to acquire different pieces of the RIA tech stack from top-to-bottom and the challenge, of course, is to integrate those pieces.

Others are opting to create new age all-in-one platforms from the ground up. In effect, the end-to-end platforms built by companies like Advyzon and Advisor360 end up looking similar to the pre-integrated tech stacks discussed above, but instead of building via acquisition they are founded with the intention to become an all-encompassing platform.

The third solution is tech stack synchronization. Under this paradigm, advisors are free to use their favorite point solutions for each level of the RIA tech stack, and use an orchestration platform to ensure that data is flowing seamlessly between them. Companies like Dispatch enable advisors to collect, structure, and sync client data across various advisor platforms, ensuring that any data changes made in the CRM are reflected in financial planning and portfolio management tools, and vice versa.

As David wrote when announcing our investment in Dispatch earlier this year, “This is one of those deep infrastructure solutions that solves an enormous pain point, offers an immediate ROI, and can run in the background as the integration layer for customer data. The more integrations they support, the more valuable they become to the industry.”

A Quick Look at Public Fintech Company Performance

For some time now, we have watched how the elevation of interest rates in the post-pandemic years have weighed on companies in the insurance, lending, and proptech subsectors. In September the Fed lowered rates for the first time in four years, and we have seen a modest uptick in affected sectors as a result.

The most striking rebound has been among the insurtech challengers we’re tracking in the F-Prime Fintech Index. Clover Health is the standout performer here, having risen more than 300 percent since the beginning of 2024, with the majority of that rise occurring in Q3. The company posted a positive net income of $7.2M for the first time since going public and improved its 2024 outlook. Another standout (and one that carries more than twice the market cap) is Oscar Health, up almost 100 percent this year.

Lending saw a partial rebound in Q3, driven by Upstart (up 70 percent quarter-on-quarter), Lufax (53 percent), and Affirm (35 percent), but the sector as a whole remains underwater compared to the beginning of this year. And proptech has also climbed since August, driven by a strong year-to-date performance from Compass (up 59 percent this year) and Redfin (up 21 percent this year, but doubling last quarter). The sector saw the biggest jump in multiples as development, financing, and transaction activity in the real-estate ecosystem generally rises in a lower interest rate environment.

Finally, to bring us full circle, we’ve also seen a strong year thus far from Robinhood, including a 42 percent bounce since a near-nadir for the year on August 5. Though it is a wealthtech company, Robinhood looks more like a bank these days, generating almost as much revenue from interest as it does from stock/crypto transactions — $285M and $327M from interest and transactions respectively in Q2. While the company’s cash balance has recently declined to $9.1B, its overall revenue has been buoyed by interest income since the Fed began hiking rates two years ago.

For a deeper look at fintech’s rebound in Q3, head over to the F-Prime Fintech Index for company specific data and comparisons against other leading tech indexes.