Welcome back to Fintech Prime Time, our monthly delivery of fintech industry data and analysis based on the F-Prime Fintech Index.

On this last day of 2024, Abdul Abdirahman, David Jegen, and Minesh Patel reflect on the fintech recovery in 2024 — and what’s on the horizon for 2025.

The 2024 Recovery Signals a New Era For Fintechs

By Abdul Abdirahman, David Jegen, and Minesh Patel

The fintech sector stands at a pivotal moment as we close out 2024. After hitting a market valuation low point in 2022, the sector has demonstrated resilience with many public and private fintechs achieving significant scale. Fintech companies also evolved from growth-at-all-costs to sustainable business models, and with the initial public offering (IPO) window reopening after a two-year drought, there is much to look forward to in 2025.

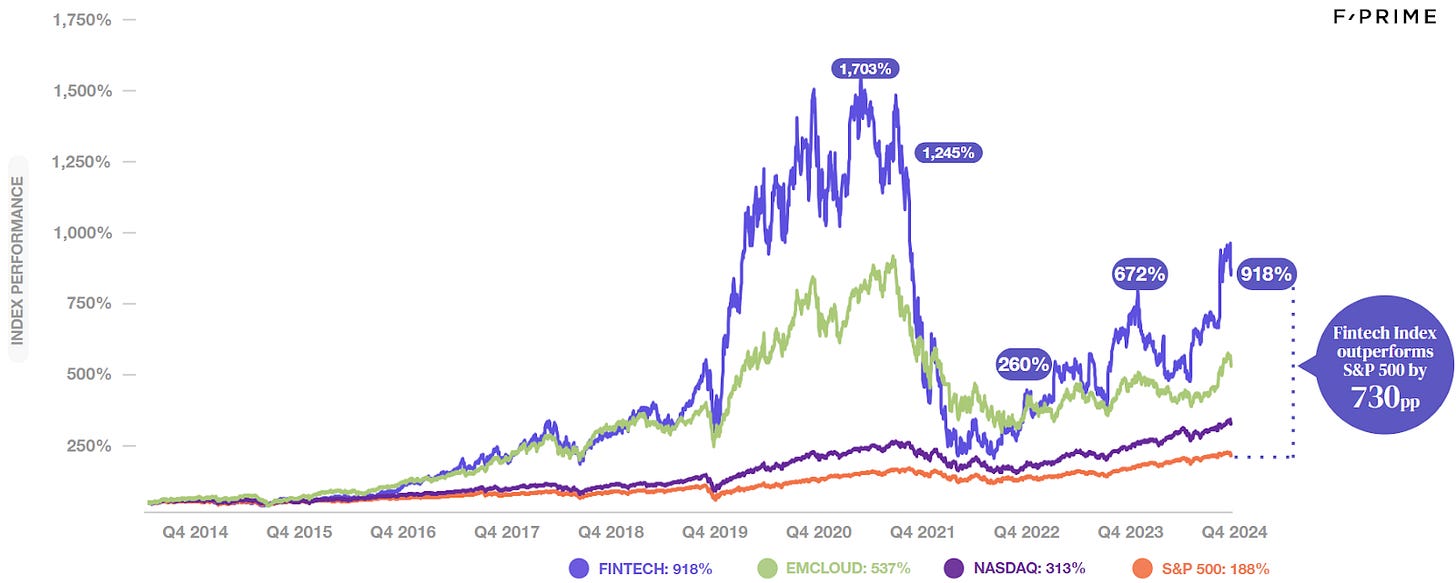

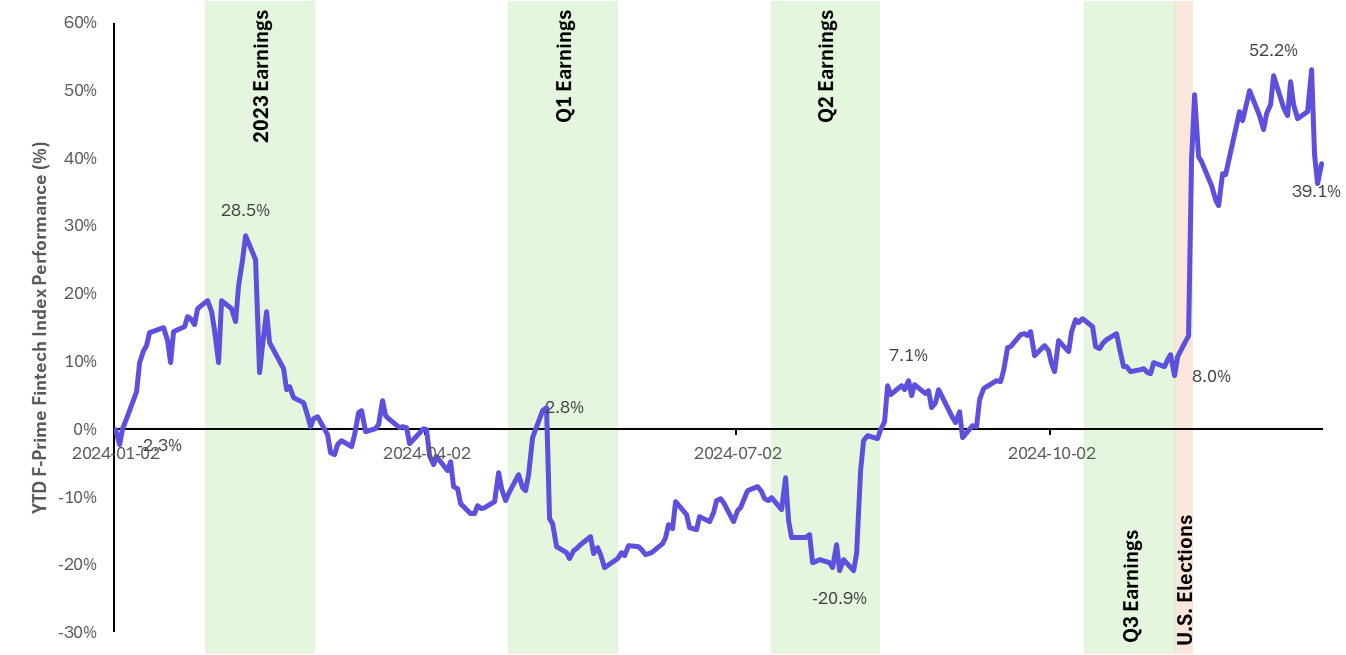

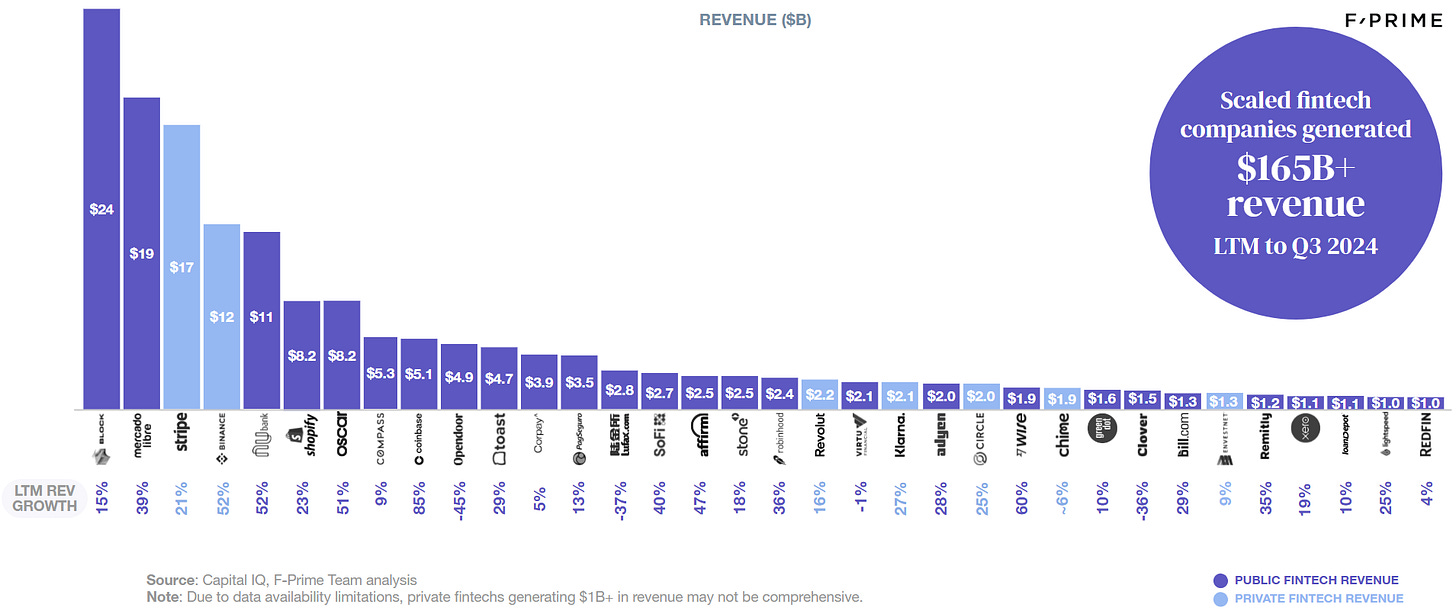

The F-Prime Fintech Index will end 2024 up ~40 percent and outperforming the Nasdaq and S&P 500, up ~33 percent and 25 percent, respectively. Over the last 10 years, the F-Prime Fintech Index is up 918 percent, outperforming the S&P 500 by 730 percentage points. Companies in the F-Prime Fintech Index added $185B in 2024 to close the year at ~$760B. They also collectively added ~$20B in revenue to end Q3 at $170B. Public fintech disruptors have more than recovered; they are becoming leaders in their categories.

Today, the majority of the companies in the Fintech Index are profitable, collectively generating ~$14B in profits. In 2021, the average revenue growth was 68 percent (vs. 17 percent today), but they were burning 21 percent of revenue on average. Like the broader stock market, fintechs received a boost with each interest rate cut, and saw a significant jump following the election results; however, the recovery has been consistent with each quarterly report highlighting strengthening fundamentals and sustainable business models.

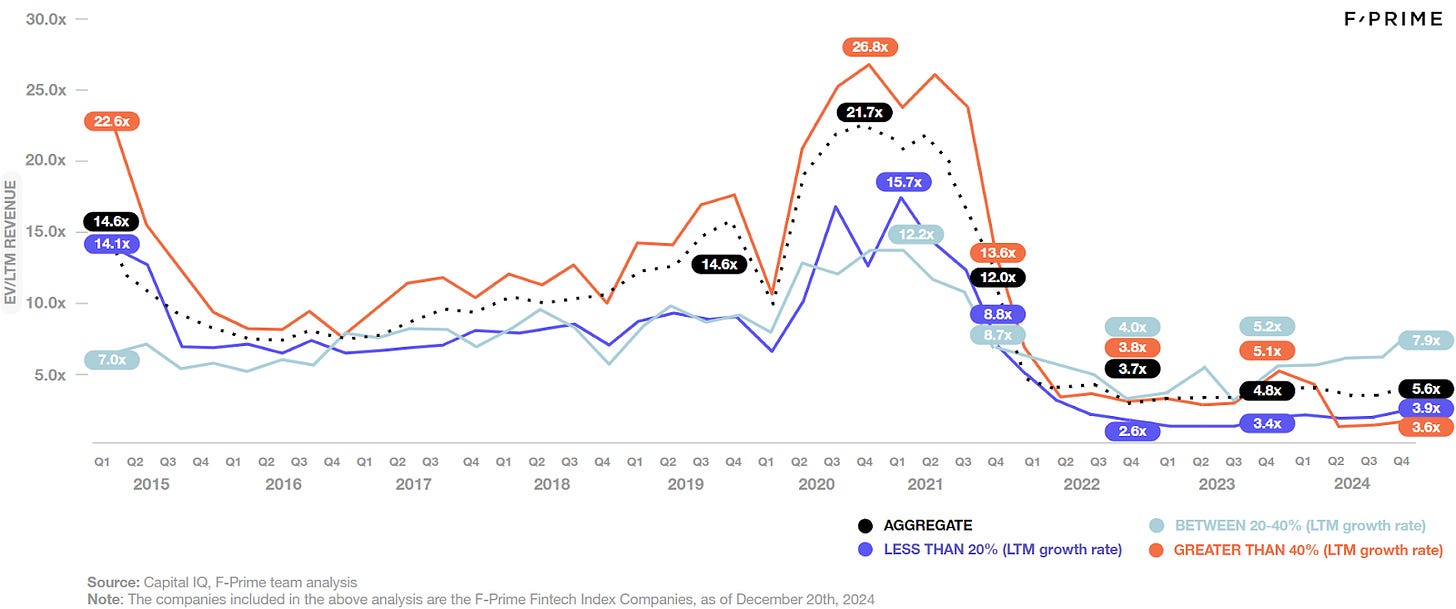

We see valuation multiples as further validation of a more disciplined market that values capital-efficient growth, with upside not yet priced in. Enterprise value to LTM revenue multiples (EV/LTM) have stabilized at 5.6x in Q4 — far below the speculative 20x+ multiples of 2021, yet also below the historical median (pre-2020) of 8-10x. Since 2022, investors have valued “goldilocks” balanced growth and profitability (7.9x) more than high growth and high losses (3.6x).

Leading the Charge: Disruptors Are Setting New Standards

The market’s growing sophistication is evident in how it rewards different business models.

Shopify’s 48 percent surge in 2024 lifted its market capitalization to $132B, reflecting not only recovery, but also the power of embedded financial services at scale. Shop Pay adoption exceeds 40 percent and payment volume is up 37 percent year-over-year.

Coinbase’s 78 percent rise to $66B demonstrates the growing institutional adoption of digital assets, even amid regulatory uncertainty. Trading volume is up 165 percent year-over-year, with over 8,000 institutions leveraging Coinbase’s prime brokerage services. Institutional revenue doubled to 10 percent of revenue over the past couple of years. The SEC’s approval of spot Bitcoin ETFs has only accelerated this institutional embrace and the incoming administration’s stance on crypto has led to a 40 percent surge in the price of Bitcoin since the election (crossing $100,000 price for the first time).

Nubank may illustrate the most impressive story of category leadership. Nubank’s valuation increased 28 percent to $47B, backed by record quarterly revenue in Q3 of $2.9B. Monthly active users have reached 110 million, of which 92 million are in Brazil, equaling 42 percent of the population. Nubank has shown that digital-first financial services can scale rapidly while maintaining quality — default rates are 30 percent below the Brazilian banking average.

Looking Ahead: 2025’s Promise

As with the broader market, fintechs will benefit from lower inflation, falling interest rates, and any deregulation by the incoming administration. We expect this will lead to more exits, M&A, and growth in 2025.

Throughout 2024, artificial intelligence moved beyond simple automation to reshaping core financial processes. Early AI implementations focused on cost reduction through task automation; however, we are beginning to see value creation and revenue generation by embedding AI in core operations.

In banking, AI co-pilots are improving lending operations by automating manual data entry, enhancing credit decisioning, and streamlining loan processing workflows. In the CFO suite, companies like Ramp and Brex are using AI to accelerate expense management and cash flow optimization, with their systems not only categorizing and auditing expenses, but also providing predictive insights for working capital management. The emergence of "agentic payments," where AI agents autonomously handle transactions, represents a promising frontier, with Stripe, Adyen, several early-stage startups, and even Coinbase developing foundational frameworks for agentic commerce.

Finally, the fintech IPO pipeline is robust with many potential additions to the F-Prime Fintech Index. ServiceTitan’s recent IPO was a litmus test for investor appetite and highlighted the market’s desire for new tech exits. With 24 percent Y/Y revenue growth and losses, investors drove up first-day valuation by 42 percent to $10B+ valuation. Klarna, Chime, and Navan have all filed confidentially to go public in 2025, while many other scaled fintechs are considering filing in 2025 and 2026, including: Cross River Bank, eToro, AirWallex, and Starling Bank.

There are already 27+ public fintech companies with $1B+ in revenue, and we look forward to welcoming many other scaled fintechs to the Fintech Index and expanding the metrics and benchmarks that we track. 2025 will be an exciting year for all of us in fintech!