Alts Have Outrun Existing Infrastructure

Welcome back.

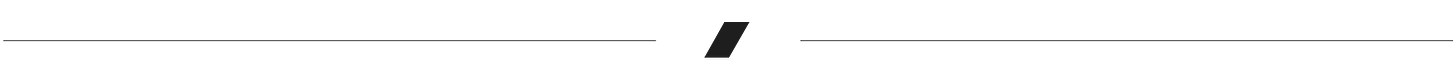

It took more than 30 years, but alternative asset classes like venture capital, private equity, and hedge funds have arrived in force. Private investments in alts grew to $13.3T from $4.6T between 2011 and 2021. Meanwhile, new kinds of alternative assets are emerging to compete for investors’ attention.

However, this expansion is seriously straining existing infrastructure, creating new opportunities for startups. In today’s edition of Fintech Prime Time, Managing Partner David Jegen will explore the industry’s changing infrastructural needs.

Modernizing Private Alts Infrastructure

with David Jegen

While traditional alternative assets like VC, PE, and hedge funds are maturing into the modern investment portfolio, an entirely new category of alternative assets has emerged. Dozens of platforms have launched to fractionalize, package, and distribute everything from farmland, litigation finance, and P2P lending to art, wine, and collectibles.

Today, I want to briefly chart the changing composition of the alts industry and highlight a few opportunities for startups to modernize existing infrastructure — or, in the case of many emerging alts, build it from scratch.

An Overview of the Alts Industry

Regulatory opening, fee pressure on public asset management, revised model portfolio allocations, and a search for diversification are driving the growth of alternative assets. In turn, that expanding TAM is bringing new players into the space, including new GPs, new distribution platforms, an expanding variety of asset classes, and new limited partners in the form of a retail investor base.

Source: F-Prime, Preqin, McKinsey, Pew Research Center

Blackstone: A Case in Point

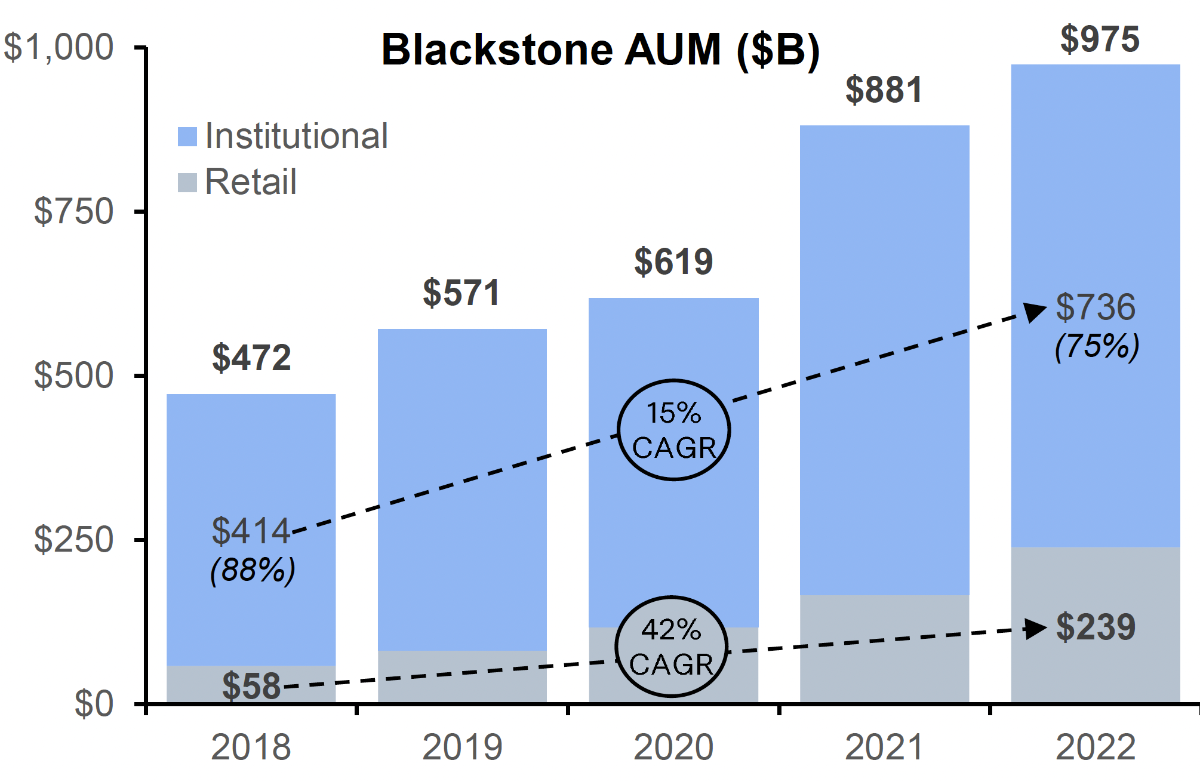

In 2010 Blackstone began developing its private wealth channel, initially via intermediaries and, more recently, through a direct investor relations sales push. In 2014, the firm launched its first open-ended funds and perpetual vehicles, with its flagship non-tradeable REIT reaching ~$70B and a private credit fund growing to ~$60B.

Overall, Blackstone’s private wealth and retail segments now represent a quarter of their AUM, well above peers like KKR (13%) and Apollo (5%), and its private wealth channel employee count has doubled in the last four years. The firm is now the world’s largest and most diversified alternative asset manager, having doubled to ~$975B over the last four years.

(Anyone care to guess the day Blackstone will cross $1T in AUM? Send your guesses to fintechindex@fprimecapital.com — winner gets a prize 👀)

Infrastructure Opportunities in Traditional Alts

User experience: The GP-to-LP user experience is a natural entry point for startups. Companies are facilitating fully digital fundraising, LP onboarding, subscription documentation, CRM, and capital calls processes. For GPs, a key benefit here is that these experiences can be improved without touching underlying fund infrastructure.

Back office and fund operations: For every dollar spent on user experience, more than 5x is spent in the back office on accounting, investment monitoring, and fund administration. While it will be tough to migrate investors off traditional platforms (like SS&C, State Street, and BlackRock/eFront), modernizing these processes with software that integrates external and internal resources, reduces double entry, maintains a single source of truth, and automates reporting is critical for achieving true scale.

Data, analytics, and aggregation: Alternative asset investors have long suffered quietly with their fund performance PDFs, thinking it was their responsibility to extract structured data and analyze investment performance across dozens of funds. Startups are now unlocking and liberating the data trapped behind PDFs, empowering alts managers and their LPs alike.

Emerging Alts: New Opportunities

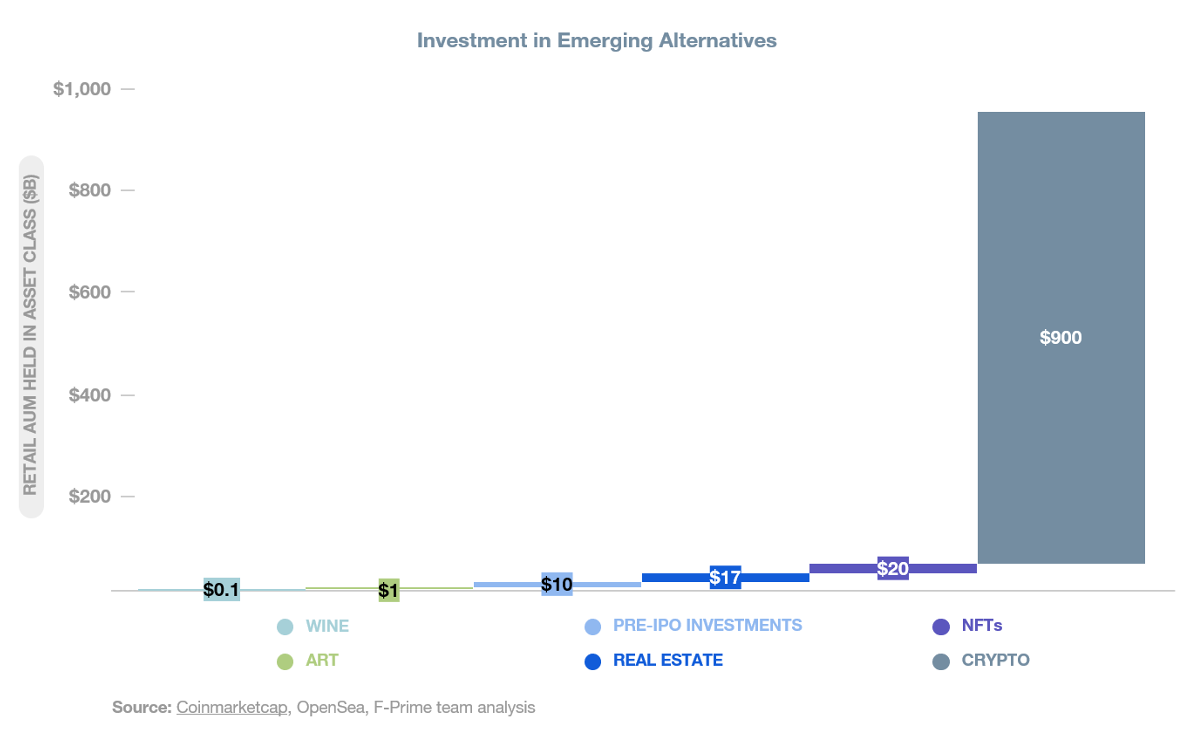

Some emerging alts have always been available to wealthy investors, but are now being fractionalized and digitized to grant access to retail investors — examples include private credit, project finance, art, music, and wine. Others, like real estate and collectibles, were already available to retail investors but are now more accessible and liquid than ever. And then there’s crypto, an asset class unto itself, which has given all investors a new asset with a variety of novel and unfolding value propositions.

Any one of these emerging alternative assets is relatively minor, but in aggregate, they are worth about $1T (despite recent sell-offs in crypto, which represents the vast majority of AUM here). They have attracted more than 120 million users globally and given birth to more than 100 distribution platforms.

Very little of today’s infrastructure is suitable for these emerging alternative classes, meaning that investors and platforms have had to cobble together their own tools and infrastructure. Overall, we see five areas requiring development — and which startups are now starting to chase.

Discovery and aggregation: At some point, markets usually see aggregators emerge to tame fragmentation and provide consolidated gateways for users — startups like Vincent and MoneyMade are starting to do for alts what Fidelity and Charles Schwab do for traditional asset classes. More importantly, however, investors need a single account to invest from. While traditional brokerages could expand into these markets, it’s more likely that an existing platform like Coinbase or one of the discovery-centric aggregators will expand into a full-service, multi-asset class brokerage.

Data analytics and aggregation: Simply put, this industry needs a Morningstar. It will not be easy to standardize and normalize the criteria for evaluating assets, as Morningstar did for mutual funds in the 1980s, but consistent measurements of risk, volatility, liquidity, and reputation are possible. Data aggregators like Altan Insights and Pricing Culture are early versions.

Investment management: Speaking of mutual funds, the long-term weight of these alternative asset classes will come from actively managed funds. Actively managed funds account for about 80% of equities market cap, and even more in fixed income, FX, and commodities. There is room for many successful players with a variety of strategies, and this will be a fee-rich category.

Custody, clearing and settlement: A range of custody issues exist, from custody of physical assets like wine or collectibles to digital assets like crypto. Clearing and settlement are in better shape, though still fragmented with smaller custodians and transfer agents, resulting in reporting and tracking complexities.

The Takeaway

Traditional alternatives are diversifying their investor base, while a new class of emerging alternative asset classes (worth $1T) cobbles together discovery data, reporting and clearing and custody where incumbent institutions have failed to step forward.

This industry has never been more exciting, but it needs serious investment in new infrastructure to scale and improve the investor experience. Now is an exceptional time to build category-defining companies.

Go deeper: Explore the Wealth and Asset Management sector on the Fintech Index.

Did someone smart forward you this email? Sign up here.