FedNow's Gaps and Opportunities

Welcome back.

Before we get started with this week’s content (which includes a look back on Q1 performance across the Fintech Index, and a deep dive on real-time payments), we wanted to thank everyone who joined our State of Fintech presentation last month. If you missed it — or want to revisit the discussion — a recording is available here.

Fintech is back... sort of: A look back on Q1

with Abdul Abdirahman, Am Ramesh, and Sarah Lamont

The Q1 numbers are in! Here are the key takeaways:

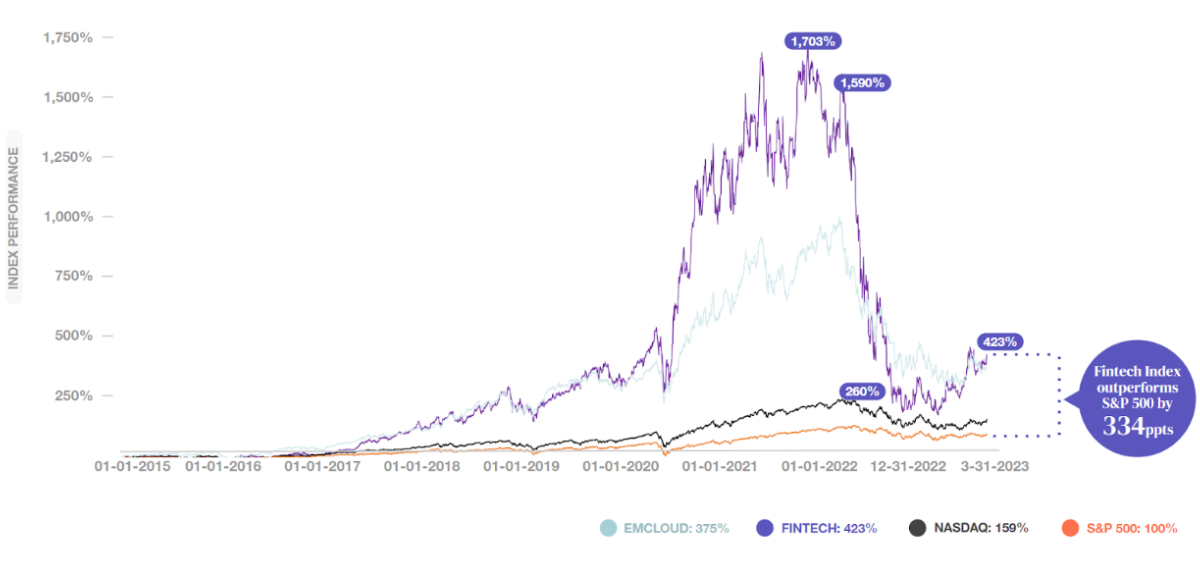

Headline: The Fintech Index was up over 45 percentage points in Q1, from 260% to 423%. The biggest contributors to this rebound were MercadoLibre (more on them below), Shopify, Coinbase, NuBank, and Adyen. That’s a big premium on other indexes: the Emerging Cloud Index was up 15 percent, Nasdaq was up ~17 percent, and the S&P 500 was up ~7 percent.

Pertinent details: Overall, the Fintech Index regained almost $70B in market cap in Q1. This led to the average market cap increasing from $7.2B to $7.6B over the last quarter.

Meanwhile, the average LTM growth rate for Fintech Index companies declined from 48 percent to 35 percent, largely due to cyclical impacts in the lending and proptech space.

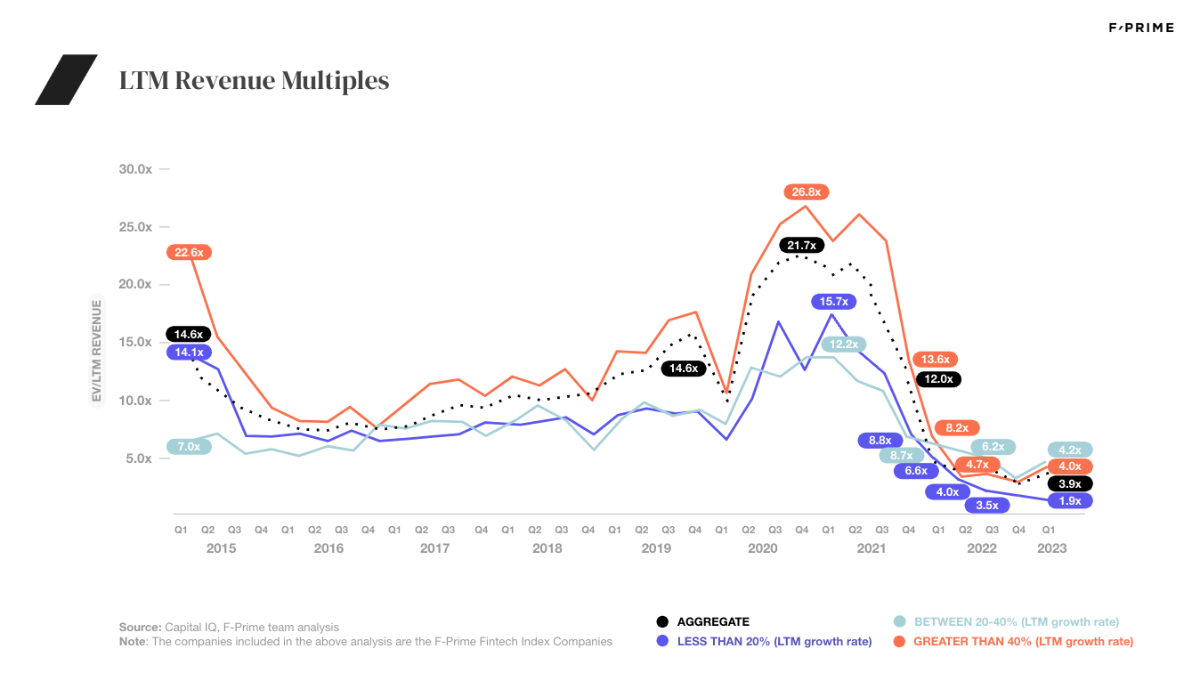

Multiples: Revenue multiples slightly rebounded last quarter, with the exception of companies growing less than 20 percent.

Those with revenue growth of more than 40 percent traded at 4x (up from 3.8x in Q4)

Companies that grew between 20 and 40 percent traded at 4.2x (up from 4x in Q4)

Companies with less than 20 percent revenue growth only traded at 1.9x, down from 2.6x the previous quarter. This segment suffered the most due to its concentration of proptech and lending companies, which have been hit hardest by rising interest rates in this cycle.

Index removals: Duck Creek Technologies was acquired by Vista Equity Partners at an 8.4x multiple to its $310M LTM revenue, while Funding Circle and Doma Holdings no longer met our criteria.

Index Additions: Given the lack of exits, there were no new companies added to the index this quarter.

Fundraising: North American fintech startups raised a total of $9.1B in Q1. That sounds like an uptick, but keep in mind that it does include the $6.5B raised by Stripe.

Choose your own adventure: Dive into the Fintech Index.

Gaps we’re seeing in the US Real-Time Payment system

with Rocio Wu

This summer, the US will finally get its very own real-time payments system, dubbed FedNow, and spectators have spilled a lot of ink wondering how and why it will differ from The Clearing House’s RTP product, same-day ACH, Visa Direct, and more.

However, our main question is whether businesses and their customers actually adopt it in the first place. As one of the last movers in this space, the US has the opportunity to learn from the rest of the world — particularly developing countries like Brazil, India, and China, where RTP has effectively leapfrogged card payments in popularity.

By comparing FedNow with its international counterparts, we’ve identified six key gaps in US payment infrastructure:

1) Bank Adoption: In the relatively decentralized US banking system — where the top five banks only account for 46 percent of total commercial assets, as opposed to 87 percent in Brazil — the largest financial institutions can’t impose a new payment system on the entire industry. Rather than proactively adopt this new infrastructure, the majority of smaller banks and credit unions are waiting to see whether incumbent providers or startups can help them integrate with FedNow rails.

2) Regulatory Power: In Brazil, the government mandated that all financial institutions with more than 500,000 customer accounts must participate in its RTP system (known as Pix) and included all major stakeholders in its design process. Meanwhile, American banks are regulated by a patchwork of state and federal government agencies — only one of which (the Federal Reserve) is in charge of implementing FedNow. The US system therefore has less regulatory heft than its international peers.

3) Consumer Protection and Fraud Management: In an effort to mitigate risks of chargebacks based on insufficient funds, both Fednow and The Clearing House’s RTP system only enable push payments. However, the majority of American financial transactions are pull-based, meaning payers provide PINs or signatures that grant recipients permission to extract funds. Meanwhile, RTP does open up new fraud vectors — mainly based on socially engineered Authorized Push Payments (APP) fraud. While Pix and India’s UPI secure accounts through tokens that trace back to users’ bank accounts, the US seems to lack the political appetite to adopt a national digital identity. In the absence of some central directory of public account identifiers, every bank will be forced to solve the identity question on its own, creating large gaps through disparate user experiences.

4) Third-Party Integration and Productization: Around the world, startups have integrated RTP technology with other financial services and engaging UX layers to facilitate its use. For example, Nubank’s Brazilian customers can pay with credit via Pix. Visitors to China, India, Singapore, and Thailand will find retailers, street food vendors and taxis displaying instant payment QR codes. In its initial form, FedNow remains a back-end system, and the front-end user experience still needs productization.

5) Backend Integration: To make payments “real-time” and convenient on the surface, a lot of things have to happen behind the scenes, from liquidity management to real-time settlement and instant reconciliation. Liquidity challenges have been a hurdle for RTP adoption, particularly for smaller FIs, and businesses and banks who participate in FedNow must reset their mindset about fully loaded liquidity — namely, by moving funds to a Federal Reserve bank account and having all required funds before paying out. Meanwhile, integration with ERP systems and instant reconciliation will be key for business adoption.

6) Interoperability: FedNow and TCH’s RTP solution will not be interoperable, nor will FedNow support international transactions. This stands in contrast to countries in Southeast Asia, which have piloted cross-border initiatives. For now, it remains to be seen who will connect FedNow with international rails and how banks and FIs are going to manage both RTP and FedNow after the latter’s launch.

FedNow ultimately serves as an incremental improvement on existing US payment infrastructure, and we’re excited to see where things go from here. For a much deeper dive into the US Real-Time Payment System’s gaps — as illustrated by overseas examples — check out my recent Forbes article here.

Did someone smart forward you this email? Sign up here.